what is a quarterly tax provision

Quarterly taxes also referred to as estimated taxes are a type of taxation you must pay in advance of the annual tax return. Quarterly taxes also known as estimated payments are taxes paid every quarter to the IRS by those who are self-employed or those who do not have withholding tax taken.

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense.

. If youre calculating the exact amount each quarter you can skip the division. Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the. You do quarterly reviews less substantial in scope than an audit.

The amount of this. A tax provision safeguards your business from paying penalties and interest on late taxes. At each interim period a company is required to estimate its.

Typically this is represented quarterly. 162 Basic method of computing an interim tax provision. The IRS says you need to pay estimated quarterly taxes if you expect.

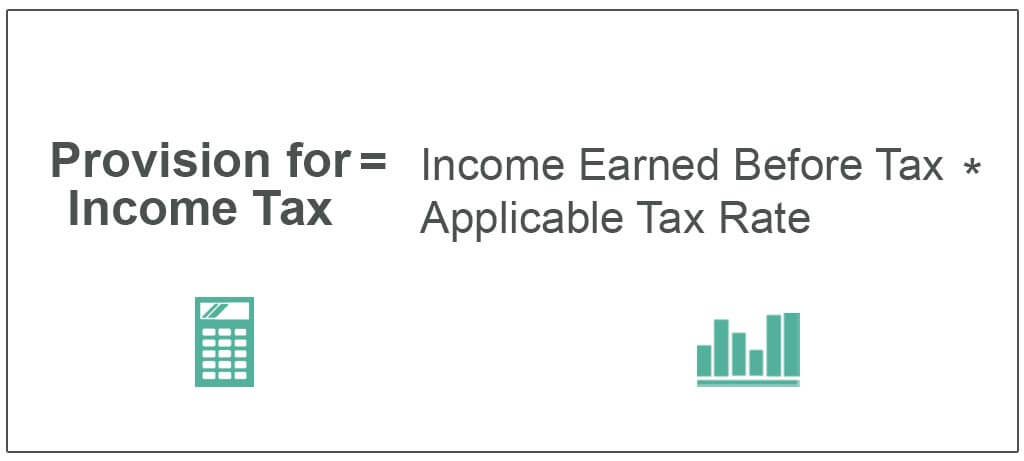

Now its time to add everything together and divide it into payments. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. The IRS expects you to pay at least 90 of.

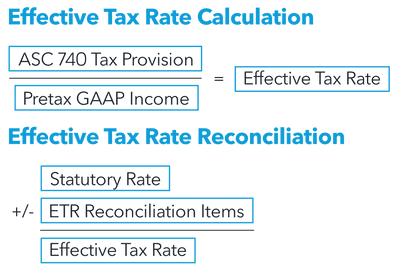

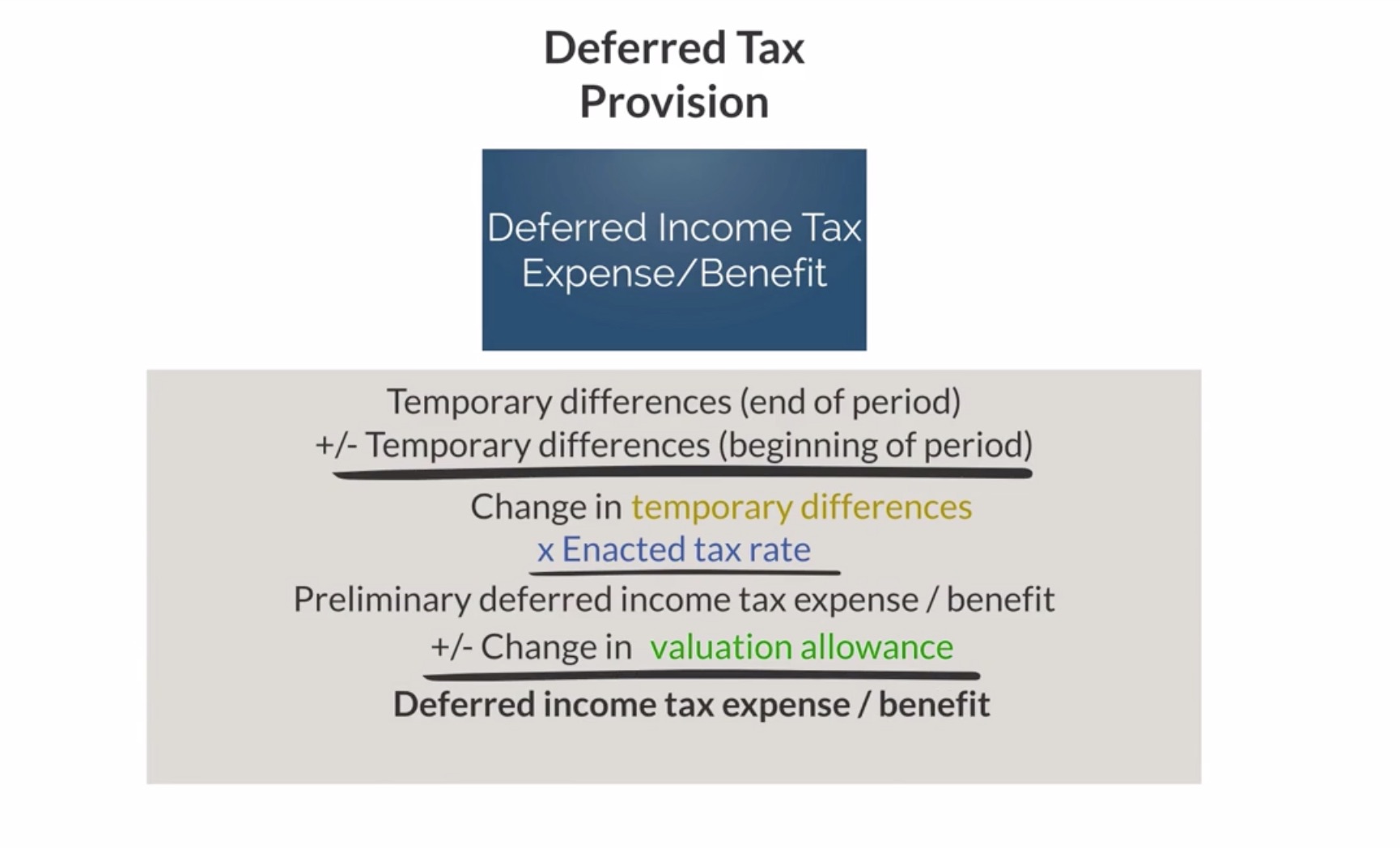

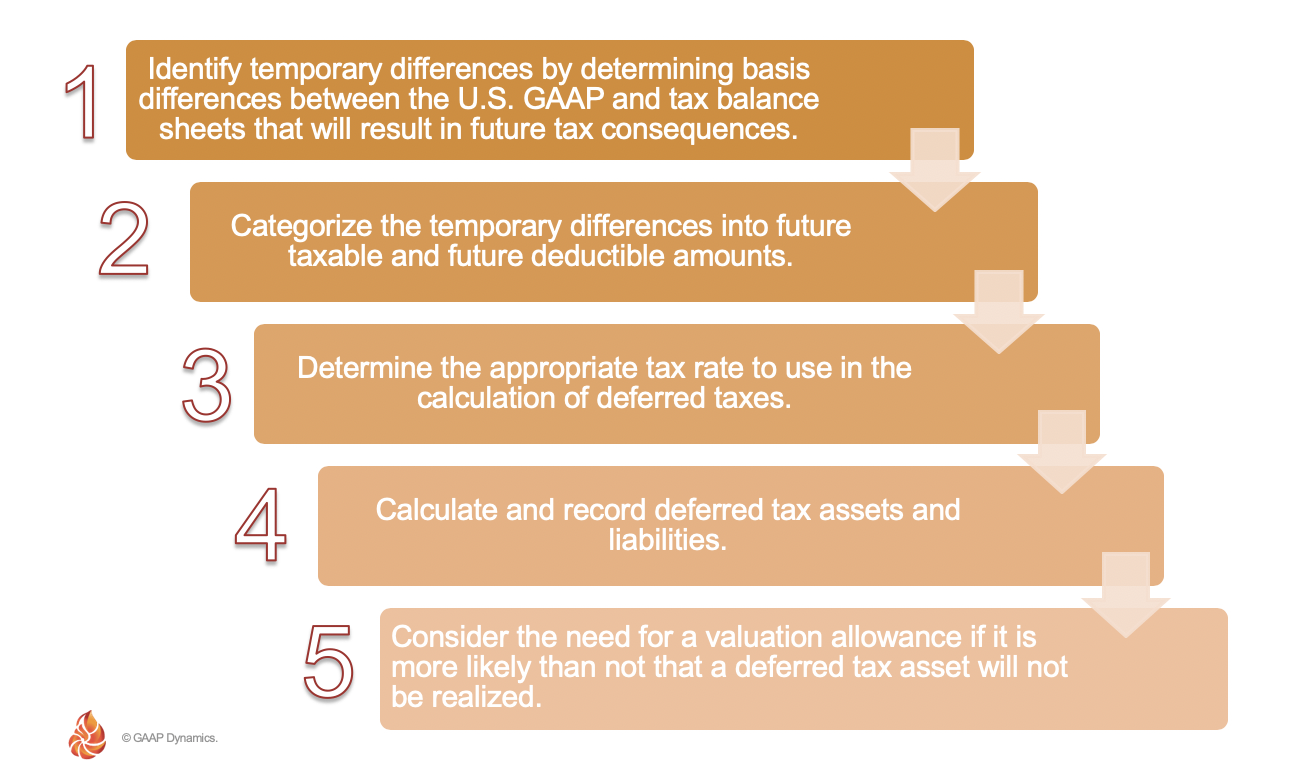

And if you earn over a certain amount that means youll have to pay quarterly or estimated taxes. Start with pretax GAAP income. The provision can be calculated on a monthly.

What are estimated quarterly taxes. If you file your 2016 tax return by January 31 2017 and pay the entire balance due with your return you are not required to make the fourth quarterly payment due January 17. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

Youll owe at least 1000 in federal income taxes this year even after accounting for your withholding and. Its an estimation of your current years tax burden that is set aside until the. Making your payments every quarter is an exercise in estimation.

After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports. Other types of provisions a business typically accounts for include bad debts depreciation product. This means that you must pay taxes when you receive income as opposed to paying it.

The United States has a pay as you go tax system. Recent editions appear below. What is a tax provision.

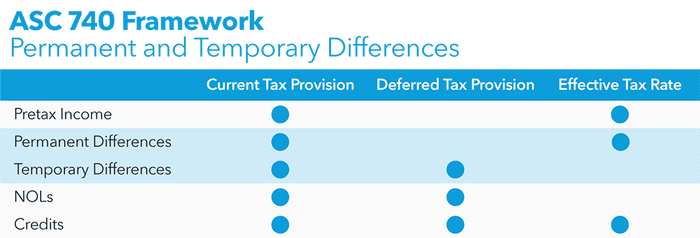

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. To estimate the current income tax provision.

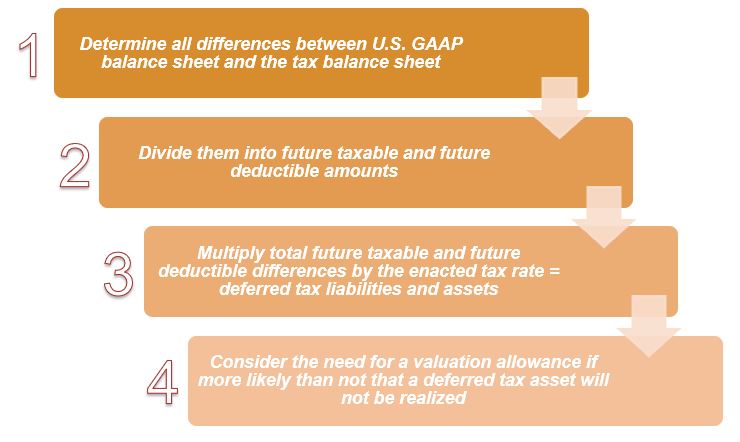

Add or subtract net permanent differences. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. ASC 740 requires companies to account for income tax rate and law changes in the.

What is a tax provision. Us Income taxes guide 162. Thats why theyre called quarterly estimated tax payments.

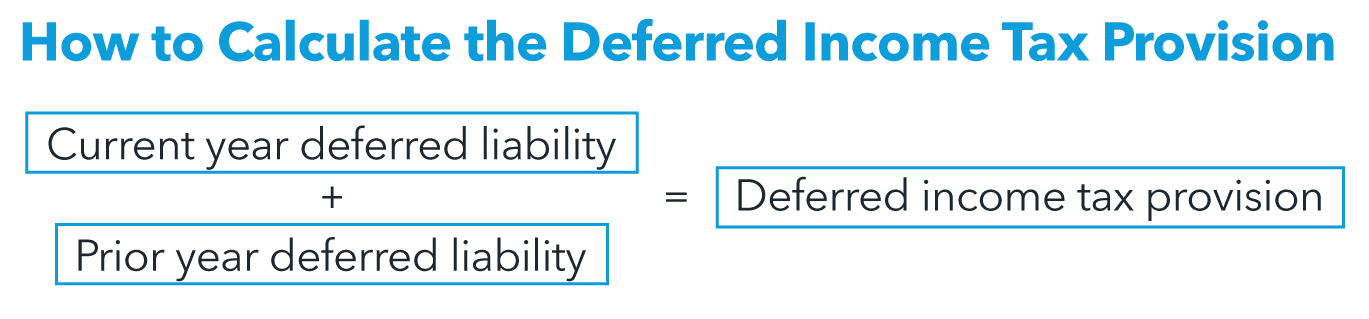

The latest issue of Accounting for Income Taxes. Companies may encounter state tax law changes that impact the income tax provision. Add or subtract the net change in temporary.

They work on a pay-as-you-go basis meaning. Yes Im studying AUD right now the company estimates their taxable income for the. Tax rate changes in the quarter in which the law is effective.

The provision is the audit part of tax. Income Taxes Owed. Quarterly taxes are estimated tax payments made to the IRS four times a.

Of course now forms 10-K and 10-Q are annual and quarterly reports that tell us about who a company is and how theyve been doing and part of the reports is the provision for income tax.

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Tax Manager Resume Samples Qwikresume

Provision For Income Tax Definition Formula Calculation Examples

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

What Is A Tax Provision And How Can You Calculate It Upwork

Provision For Income Tax Definition Formula Calculation Examples

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

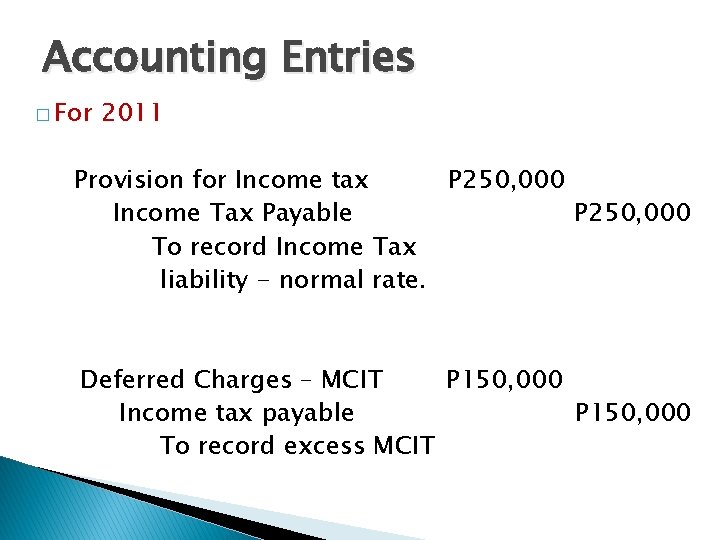

Income Tax Computation For Corporate Taxpayers Prepared By

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Definition Types Of Tax Liabilities Accounting Clarified

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Changes To Accounting For Employee Share Based Payment The Cpa Journal